What HVAC Tax Credits Are Available in 2025?

The Inflation Reduction Act (IRA) of 2022 has brought significant financial incentives for American homeowners to upgrade their homes with energy-efficient systems.

As part of this act, the Energy Efficient Home Improvement Credit (25C) has been introduced to help homeowners reimburse the costs of energy-efficient home improvement projects.

This comprehensive guide will explore the available tax credits for homeowners in 2025, helping you navigate the complex world of energy efficiency incentives and make informed decisions to optimize your tax savings.

Key Takeaways

- Expanded tax credits for energy-efficient home improvements through 2032.

- Different types of equipment qualify for tax credits, including heat pumps and furnaces.

- Maximum credit amounts available for different types of equipment.

- Strategic planning for home improvements to maximize tax benefits.

- Qualification requirements and documentation needed for claiming tax credits.

Understanding HVAC Tax Credits in 2025

As we dive into 2025, understanding the nuances of HVAC tax credits becomes crucial for homeowners looking to upgrade their heating and cooling systems. The federal government continues to support energy-efficient home improvements through tax incentives, making it an ideal time to invest in modern HVAC technology.

The Inflation Reduction Act and Its Impact

The Inflation Reduction Act has played a significant role in shaping the current landscape of HVAC tax credits. By extending and enhancing these credits, the Act has made energy-efficient upgrades more attractive to homeowners. To qualify, the efficiency upgrades must be made on an existing home that is your main residence. This means that vacation homes, commercial buildings, and rental units are not eligible for these tax credits.

All of these federal tax credits for energy-efficient upgrades to your home are available every year until 2032. This allows homeowners to budget for multiple projects over the next few years, making it easier to plan and execute necessary home improvements.

Why HVAC Tax Credits Matter for Homeowners

HVAC tax credits provide substantial financial relief for homeowners facing the high upfront costs of replacing or upgrading heating and cooling systems. By offering these credits, the government incentivizes homeowners to adopt energy-efficient technologies, which can lead to significant savings on utility bills. Modern energy-efficient HVAC systems can reduce monthly utility bills by 20-40%, and the tax credits help offset the initial investment, improving your return on investment.

Some key benefits of HVAC tax credits include making premium, high-efficiency equipment more accessible, reducing overall household energy consumption, and allowing for strategic planning of multiple home improvement projects over several years. By understanding and utilizing these tax credits, homeowners can enjoy a significant discount on necessary home improvements that enhance comfort and reduce long-term operating costs.

Overview of Available HVAC Tax Credits

In 2025, homeowners can take advantage of two major tax credits designed to encourage energy-efficient home improvements. These credits are part of the broader effort to reduce energy consumption and promote cleaner energy solutions.

Energy Efficient Home Improvement Credit (25C)

The Energy Efficient Home Improvement Credit (25C) is a valuable incentive for homeowners looking to upgrade their HVAC systems. This credit allows homeowners to claim a percentage of the cost of qualifying energy-efficient improvements.

Key benefits of the 25C credit include:

- A tax credit of up to $1,200 for certain energy-efficient improvements

- A lifetime limit for the credit, making it essential to plan improvements strategically

- The ability to combine this credit with other incentives, potentially increasing overall savings

Homeowners should be aware that the 25C credit has specific requirements and limits. For instance, the credit applies to certain HVAC equipment that meets energy efficiency standards set by the government.

Residential Clean Energy Credit (25D)

The Residential Clean Energy Credit (25D) offers a substantial 30% tax credit for renewable energy systems with no upper dollar limit. This makes it one of the most generous tax incentives available to homeowners.

- This credit applies to a range of clean energy technologies, including geothermal heat pumps, solar water heating systems, and battery storage technology.

- Unlike the 25C credit, the 25D credit has no annual maximum dollar amount, allowing homeowners to claim 30% of the full cost of qualifying systems.

- The 25D credit remains at 30% through 2032, then steps down to 26% in 2033 and 22% in 2034 before expiring.

For example, for geothermal heat pump systems, which can cost between $20,000 and $30,000, this credit can provide $6,000 to $9,000 in tax savings, significantly improving the return on investment.

Heat Pump Tax Credits for 2025

Heat pump tax credits for 2025 are designed to encourage homeowners to adopt more energy-efficient heating solutions. These credits are part of the broader efforts to reduce energy consumption and promote environmentally friendly home improvements.

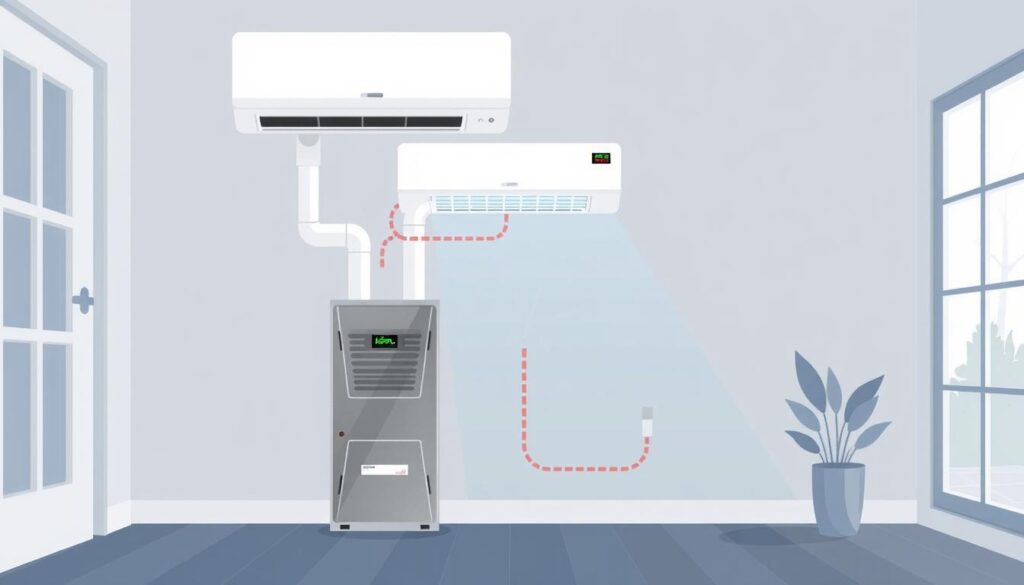

Air Source Heat Pump Credits

Air source heat pumps are an efficient way to heat and cool homes. To qualify for the tax credit, these pumps must meet or exceed the Consortium for Energy Efficiency’s (CEE) highest efficiency tier in effect at the beginning of the installation year. Homeowners can claim a tax credit of up to $2,000, which covers 30% of the cost, including installation expenses.

Efficient Heating: Air source heat pumps provide both heating and cooling, making them a versatile solution for home climate control. By qualifying for the tax credit, homeowners can offset the initial investment and enjoy reduced energy bills.

Heat Pump Water Heater Credits

Heat pump water heaters are another highly efficient solution for homeowners, using up to 70% less energy than conventional electric resistance water heaters. Like air source heat pumps, they qualify for a tax credit of 30% of the cost, up to $2,000.

- High Efficiency: Heat pump water heaters must meet or exceed the CEE’s highest efficiency tier.

- Flexibility: Both electric and natural gas heat pump water heaters are eligible.

- Substantial Savings: The energy savings can be significant, often paying back the initial investment within 3-5 years.

Maximizing Savings: Homeowners can potentially claim the $2,000 credit for heat pump water heaters in addition to other energy-efficient improvements, up to their respective limits.

Air Conditioner and Furnace Tax Credits

The Inflation Reduction Act has made tax credits available for homeowners who install energy-efficient HVAC equipment, including air conditioners and furnaces, in 2025. This initiative aims to encourage homeowners to upgrade to more efficient systems, reducing energy consumption and environmental impact.

Central Air Conditioner Credits

While specific details on central air conditioner credits are not provided, homeowners can generally benefit from the Energy Efficient Home Improvement Credit (25C) if their air conditioning systems meet certain efficiency standards. It’s essential to check the latest guidelines from the ENERGY STAR program or consult with a tax professional to determine eligibility.

Furnace and Boiler Credits

High-efficiency furnaces and boilers qualify for a tax credit of 30% of the cost, up to a maximum of $600 in 2025. This credit covers both equipment and installation costs. To qualify, gas furnaces must be ENERGY STAR certified with an Annual Fuel Utilization Efficiency (AFUE) rating of 97% or higher. Oil furnaces and boilers have different efficiency requirements but can also qualify for the same credit amount if they meet specified criteria.

Key Benefits:

- High-efficiency furnaces and boilers can reduce heating costs by 15-30% compared to standard efficiency models.

- The $600 maximum credit for furnaces and boilers falls under the overall $1,200 annual cap for energy-efficient home improvements.

- Beginning in 2025, qualifying furnaces and boilers must have a manufacturer-issued Product Identification Number (PIN) that must be included on your tax return.

Other Qualifying HVAC Equipment

As homeowners explore HVAC tax credits for 2025, it’s essential to consider other qualifying equipment beyond the primary systems. The Inflation Reduction Act has expanded the list of eligible improvements to include various components that support energy-efficient home upgrades.

Biomass Stoves and Boilers

Biomass stoves and boilers are another category of HVAC equipment that qualifies for tax credits. These systems, which burn organic materials like wood pellets or agricultural waste, offer a renewable energy alternative for heating. To qualify, biomass stoves and boilers must meet specific efficiency standards and be certified by a recognized testing laboratory.

The tax credit for biomass stoves and boilers can help offset the cost of these systems, making renewable energy sources more accessible to homeowners.

Electrical Panel Upgrades

Upgrading electrical panels is often a necessary step when installing new energy-efficient HVAC systems, particularly heat pumps. The good news is that electrical panel upgrades can also qualify for a tax credit.

- To be eligible, the upgraded panel must have a capacity of at least 200 amps and meet National Electric Code requirements.

- The credit covers 30% of the cost, up to $600 per item, helping homeowners manage the expense of preparing their homes for modern electric HVAC equipment.

- This incentive is particularly valuable for older homes that may not have sufficient electrical capacity to support new energy-efficient systems.

By including electrical panel upgrades in the list of qualifying improvements, the tax credit program acknowledges the importance of ensuring that homes are equipped to safely and efficiently support new HVAC systems.

Important Changes for HVAC Tax Credits in 2025

Homeowners looking to upgrade their HVAC systems in 2025 should familiarize themselves with the latest changes to tax credits and efficiency standards. These updates are crucial for maximizing the benefits of energy-efficient home improvements.

New Manufacturer Requirements and PINs

One significant change for 2025 is the introduction of new manufacturer requirements and the use of Product Identification Numbers (PINs). This development aims to enhance the qualification process for tax credits. Manufacturers are now required to provide specific information about their products, including energy efficiency ratings and other relevant details. This change ensures that only qualifying products are eligible for tax credits, making it essential for homeowners to verify the PINs when purchasing HVAC equipment.

Key Requirements:

- Manufacturers must provide detailed product information.

- Products must meet or exceed the Consortium for Energy Efficiency (CEE) highest efficiency tier.

- ENERGY STAR certification is required for certain products.

Updated Efficiency Standards

The efficiency standards for HVAC equipment are also being updated in 2025. To qualify for tax credits, air conditioners must achieve a SEER2 rating of 16 or higher, while gas furnaces must have an AFUE of 97% or higher. Heat pumps must meet the CEE’s highest efficiency tier requirements, which include minimum SEER2, EER2, and HSPF2 ratings that vary by region.

| Equipment Type | Efficiency Requirement |

|---|---|

| Air Conditioners | SEER2 rating of 16 or higher |

| Gas Furnaces | AFUE of 97% or higher |

| Heat Pumps | CEE’s highest efficiency tier requirements |

These updated standards ensure that tax credits support truly high-efficiency equipment. Homeowners should consult with qualified contractors to ensure the equipment they’re considering meets the efficiency standards in effect for the installation year.

Maximizing Your HVAC Tax Credits

By combining federal tax credits with other incentives, homeowners can dramatically reduce the cost of their HVAC upgrades. To achieve this, it’s essential to understand the various options available and how to strategically plan your home improvements.

Strategic Planning for Multiple Improvements

When making multiple home improvements, strategic planning is key to maximizing your tax credits. Homeowners should consider the overall energy efficiency goals of their home and prioritize improvements that offer the greatest benefits. For instance, installing a high-efficiency heat pump and upgrading to a programmable thermostat can be a powerful combination. It’s also important to keep in mind that some improvements may have a higher upfront cost but offer greater long-term savings.

As noted by the IRS, “taxpayers can claim credits for qualified energy-efficient home improvements made during the tax year.” This means that homeowners can plan their improvements over multiple years to maximize their tax credits. By doing so, they can ensure they are taking full advantage of the available incentives.

Combining Federal Credits with State and Utility Incentives

Homeowners can further maximize their savings by combining federal tax credits with state and utility incentives. Many states offer their own tax credits, rebates, or low-interest financing for energy-efficient home improvements. For example, some states have implemented point-of-sale rebate programs that reduce the upfront cost of equipment. Local utilities also frequently provide rebates for high-efficiency HVAC equipment, sometimes offering hundreds or even thousands of dollars in additional savings.

To make the most of these incentives, homeowners should research available programs through resources like the Database of State Incentives for Renewables & Efficiency (DSIRE) or consult with local HVAC contractors familiar with regional programs. By combining these incentives, homeowners can significantly reduce the net cost of their energy-efficient HVAC upgrades.

Eligibility Requirements for HVAC Tax Credits

To benefit from the HVAC tax credits available in 2025, it’s essential to comprehend the eligibility criteria. The Energy Efficient Home Improvement Credit (25C) and other related credits have specific requirements that homeowners must meet to qualify.

Qualifying Home Types

The type of home you own plays a significant role in determining your eligibility for HVAC tax credits. Generally, the home must be your primary residence, where you live most of the time. This means that vacation homes, second homes, and investment properties typically do not qualify for the 25C credit.

- The home must be your main residence to qualify for the 25C credit.

- For the 25D credit, second homes can qualify if they are equipped with renewable energy systems.

Primary Residence Rules

The IRS defines your primary residence as the home where you spend the majority of the year and have official connections, such as voter registration and driver’s license. If you have multiple residences, only improvements made to your primary residence can qualify for the 25C HVAC tax credits.

It’s also important to note that if you change your primary residence during the tax year, improvements to either home may qualify if it was your primary residence at the time of installation. This rule allows homeowners who move to still benefit from the tax credits.

How to Claim Your HVAC Tax Credits

The process of claiming HVAC tax credits involves completing the appropriate IRS forms and ensuring you have the necessary documentation. Homeowners must be diligent in maintaining records and following the correct filing procedure to successfully claim their credits.

Required Documentation

To claim HVAC tax credits, it’s essential to have the right documentation. This includes receipts for the equipment purchased, records of installation, and any other relevant paperwork. Keep all receipts and certificates provided by the installer or manufacturer, as these will be necessary for completing your tax claim.

- Receipts for HVAC equipment and installation services

- Manufacturer certifications for energy-efficient products

- Records of payment and any financing documents

Having these documents readily available will streamline the process of claiming your tax credits and ensure you can provide the necessary information to the IRS.

Filing Process with Form 5695

To claim your HVAC tax credits, you must complete IRS Form 5695, Residential Energy Credits, and submit it with your annual tax return. The form is divided into two parts: Part I for the Residential Clean Energy Credit (25D) and Part II for the Energy Efficient Home Improvement Credit (25C).

| Credit Type | Form Part | Description |

|---|---|---|

| Residential Clean Energy Credit (25D) | Part I | Claim for clean energy improvements like solar panels |

| Energy Efficient Home Improvement Credit (25C) | Part II | Claim for energy-efficient home improvements like HVAC systems |

When completing Form 5695, you’ll need to categorize your expenses according to the specific type of improvement and apply the appropriate credit limitations for each category. Ensure you follow the IRS instructions carefully to avoid any errors.

As noted by the IRS, “You must claim the credit for the tax year when the property is installed, not merely purchased.” This distinction is crucial for determining the correct year to claim your credit.

“The credit is nonrefundable, so you can’t get back more on the credit than you owe in taxes.”

By understanding the required documentation and filing process, homeowners can successfully claim their HVAC tax credits and enjoy the benefits of their energy-efficient home improvements.

Common Mistakes to Avoid When Claiming HVAC Tax Credits

The process of claiming HVAC tax credits is fraught with potential missteps that can jeopardize the entire claim. Homeowners must be vigilant to ensure they receive the credits they are eligible for.

Installation Timing Issues

One critical error is misunderstanding the installation timing requirements. Credits are only available for equipment installed during the tax year for which the credit is being claimed. Homeowners should verify that their installation dates align with the tax year to avoid disqualification.

Missing Documentation

Inadequate documentation is a primary reason for denied HVAC tax credits. Homeowners should keep detailed records, including receipts and manufacturer certifications. As the IRS notes, “Maintaining thorough documentation is crucial for substantiating tax credit claims.” Failing to obtain and report the Product Identification Number (PIN) for qualifying equipment installed in 2025 or later will result in automatic disqualification. Key documents to retain include:

- Receipts for the equipment and installation

- Manufacturer certifications confirming the equipment meets efficiency standards

- Product Identification Numbers (PINs) for equipment installed in 2025 or later

By avoiding these common mistakes, homeowners can ensure they successfully claim their HVAC tax credits and maximize their energy savings.

Planning Your Energy-Efficient Home Upgrade for 2025

The key to maximizing your energy-efficient home upgrades lies in careful planning and leveraging the available tax credits and incentives. With federal tax credits and utility rebates available through 2032, homeowners can embark on a multi-year plan to improve their homes.

Start by assessing your home’s current energy efficiency with a professional audit, eligible for a $150 tax credit. Consider replacing old HVAC systems with high-efficiency alternatives like heat pumps, which can qualify for a $2,000 tax credit. Additionally, look into other improvements such as insulation upgrades and installing energy-efficient windows.

By strategically planning your upgrades and combining federal tax credits with state and utility incentives, you can significantly reduce your energy costs and enhance your home’s value and comfort. Develop a plan that prioritizes improvements based on your budget and potential energy savings.